As we move into the Connected Decade, a 10-year period of progress empowered by technology and connectivity, dealerships are again at an inflection point for evolving business models. The general consumer wants to spend less time at the dealership and more time researching online in their own time. And less face-to-face time with customers seems to mean less opportunity for dealers to establish trust, educate consumers and leverage F&I-focused conversations — at least on the surface. The well-earned dealer reputation of resiliency and adaption in the face of market evolution is once again being put to the test.

Fortunately, the majority of car buyers indicated in a recent study that they’re still keen to talk to the dealership team to affirm what they’ve learned through their online research. And consumers aren’t giving up their steadfast interest in test-driving the vehicle in person, either. But this may not be as linear of a process as it has been in the past traditional sales model.

Online and Offline Communication With the Dealership: A Hybrid Approach

Consumers want the car-buying experience to be on demand, and that means leveraging a mix of online and offline options. In our recent Assurant study, we found that, while 90% of auto shoppers conduct online research prior to entering the dealership, only 38% of them believe it’s the best way to learn more about purchasing or leasing a vehicle. In addition, only 15% of drivers say that, in their most recent car purchase, they completed the final step of the process (making payment) over the web.

Dealers who can personalize and make the omnichannel transaction easy will engage more buyers:

- 89% of car buyers would be more likely to purchase from a dealership that offered online options.

- 94% want the time-consuming portions to switch to online platforms.

- 95% of consumers want a combination of offline and online options during their car purchasing journey.

This discrepancy indicates an unfulfilled need for the consumer. While they want to access information online, they’re either not finding all of the information they need or they’re looking for affirmation in the decisions they’ve made up until that point. They want a convenient online experience that’s complemented by the expertise of the dealership. When consumers reach out to the dealership, it could be because 62% of them still need help and insight from dealership staff. But they want much of those communications to be through an online channel where they can carry out negotiations, access deeper vehicle education, secure financing and F&I.

With the onset of the COVID-19 pandemic, this trend has gone into hyperdrive with the majority of those who completed the sale of a vehicle purchase reporting that they used a combined online/offline approach. These customers also report wanting a more formalized online option, especially to communicate directly with sales staff online and to research protection products.

And while consumers spend more time online, many dealerships worry about how to fold in the concept of preselling F&I to their consumers. The traditional method of selling F&I products at the end of the transaction where protection products are positioned as add-ons is undergoing a major shift in confidence. With today’s technology-dependent vehicle systems and on-the-go lifestyles, consumers are prioritizing convenience and easy protection solutions. 92% of buyers want to learn more about F&I products and review product details online in advance of making a purchase.

All Roads Still Lead Here: The Test Drive

While disruptive competitors have introduced entirely virtual buying options, key aspects of the customer journey will still rely on face-to-face interactions with the dealership team — primarily for the test drive event. And, whether it’s an impromptu test drive at the dealership or a scheduled one at home or work, this represents a key advantage for brick-and-mortar dealers because, in the blended experience, buyers arrive at the test drive armed with a good portion of the information needed to make an informed purchase.

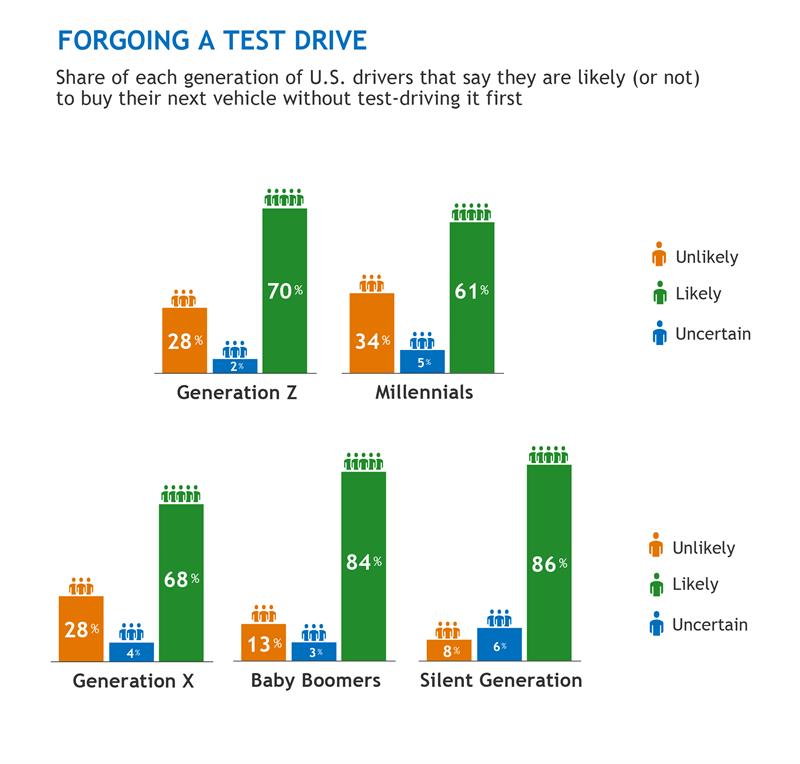

Our research suggests that most consumers would be happy to complete the sale of a vehicle online as long as they can still test-drive the car in person. Across each generation of drivers, an average of almost 74% responded they would be unlikely to purchase a vehicle without test driving it first.

Among those generations, millennials were only 34% likely to forgo the test drive experience prior to purchasing their next vehicle. Tied behind are the Generation X and Generation Z who indicated they’d be 28% likely to purchase without the test drive. Meanwhile, Baby Boomers and the Silent Generation were over 80% unlikely to buy their next vehicle without the test-drive.

This variation between generations likely indicates a trust and familiarity with the traditional sales model versus the emerging shift in the industry and its reliance on digital methods to attract and educate car buyers. Despite the differences, however, each generation appears to be deeply connected to the test drive experience as part of the car buying process.

The multitude of ways a consumer can opt to take the test drive — such as scheduling a test drive at their home or work, or visiting the dealership in person — highlights the importance of integrating strategic sales methods like F&I sales into the presale shopping experience. Aligning the preinterview/interview process in this way will uncover the needs awareness and is critical to setting the stage for a smoother, more informed sale.

Using the Test Drive to Win the F&I Sale

-

Pay attention to what you learned about the consumer digitally — If you shared information over email or exchanged discussions over videoconferencing, this is a good time to compile it together to fully understand their needs.

- When you’re scheduling the test drive, ask the right questions — Ask important lifestyle and driving habits questions to determine how far they’ll drive a year, their maintenance schedules, if they drive more in the city versus highway and so on.

- Consider your audience and demographic — Consult the graph above related to the generation’s likelihood of forgoing the test drive. How can you tailor your approach and conversation based on some of their needs or concerns?

The Nontraditional Future of the Traditional Dealership

A new kind of automotive dealership is emerging in response to consumer expectations around the car-buying experience. True omnichannel dealers will create opportunity by offering a seamless and transparent buying experience enriched by online resources that complement real human expertise. By preparing for the test drive as the crucial moment where dealerships have the customer’s undivided attention, those who are positioned to close the sale and match the customer to the right F&I product will excel in this new buying experience.

To learn more about the need for increased capabilities in the Connected Decade, talk to a digital retailing expert.